CRM ushered in a competitive advantage in the financial market

The number of financial services firms is increasing very fast and the resulting competition is putting a lot of pressure on most companies. Some companies are losing clients to competing firms while some are having challenges attracting new clients. The development and implementation of CRM systems has come at a time when financial institutions need innovative solutions to gain a competitive advantage in the financial market. Recent data suggests a success rate of "36% increase in customer satisfaction among Salesforce’s financial services sector." Salesforce Financial Services Cloud has changed the way their services are delivered, allowing room for institutions like Barclays to be creative and develop various ways of running cost-effective campaigns that leave their clientele satisfied. By implementing CRM, any financial system can get ahead of the rest of the competition without the need of using extensive resources and time.

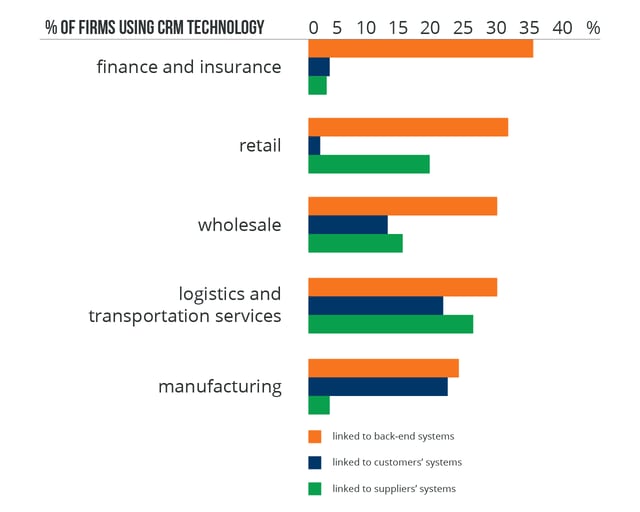

Datachart showing the rise of CRM in different sectors

Personalized services

CRM affords financial institutions an opportunity to get in touch with customers and develop personal relationships with each customer. The ability to deliver personalized services is a huge competitive advantage in the financial market. The more a firm knows its customers, the easier it will be to develop and offer personalized services that are specific to each customer’s needs. Personalized offers and services have high success rates with leading financial firms. This also makes it possible to provide better customer support and improve the firm’s reputation. Happy and satisfied customers are the backbone of financial institutions and implementing CRM can deliver that result. Nurture deeper relationships with clients and prospects by gaining a better understanding of their needs using a data integrated approach and proactive tracking realised using Salesforce Financial Services Cloud.

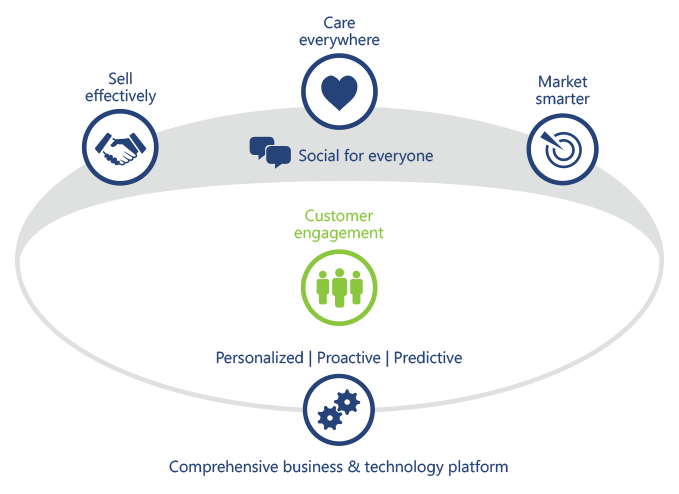

CRM provides Personalized customer services as well as a real-time market view in financial services

The Commonwealth Bank of Australia implemented Salesforce’s CRM technology to develop personalized relationships between the bank itself and the customers using social platforms. The result completely changed and reinvented the bank’s image and the way it offers financial services to clients. On a similar note, “73% of top rated marketers worldwide acknowledge that Salesforce customer journey strategy has positively contributed to overall customer satisfaction in the industry."

Closing deals faster at less cost

In order to gain and maintain a competitive advantage in the financial market, firms need to be able to offer deals and close them at less cost. The best way to achieve that in this current competitive market is by using CRM to run targeted campaigns based on personal relations developed through the CRM platform. By reducing the amount of time and resources needed to close a deal through automation facilities afforded by CRM, firms can offer more services at a fast pace and gain an advantage over competing companies. This is even more important for start-up financial institutions that are still trying to gain ground and create long-lasting reputations.

Over 2000 financial-service firms were interviewed and 51% of the firms said that they used CRM to increase the efficiency and effectiveness of their sales staff. In addition, 82% of the financial institutions interviewed acknowledged that CRM-based systems had the ability to earn and retain more customers if implemented properly.

Improved efficiency and service delivery

Implementing CRM brings the opportunity of automated services. Instead of employees working to manually perform tasks, financial institutions can usher in a CRM system to automate day to day and repetitive tasks so the employees can focus their time and efforts on other sectors of the business that need human attention. This provides an increased level of efficiency, especially with service delivery. High-quality service delivery to customers and associates sets up a huge competitive advantage in the financial market and can be the ultimate difference to a company as far as gaining income is concerned. Automate routine processes with smart process rules that are easy to create using Salesforce for Financial Services CRM.

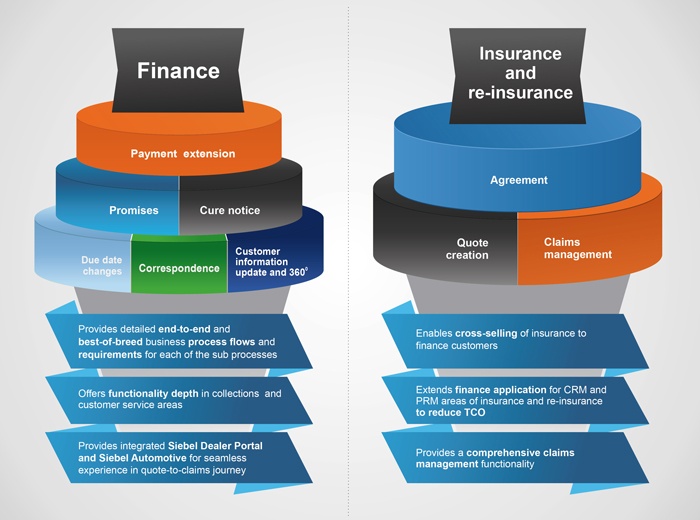

The various roles of CRM in a financial service

Barclays Bank introduced Salesforce CRM to improve its relationship with customers that sought mortgages for home buying. The system put in place simplified the application process for many mortgage brokers and customers in the UK. On a normal year, external brokers arrange 60% of mortgages in the UK. The introduction of a community platform allowed Barclays to build deep relationships with all 16,000 external mortgage brokers in the UK, which helped the bank offer customized mortgage deals with the general customers.

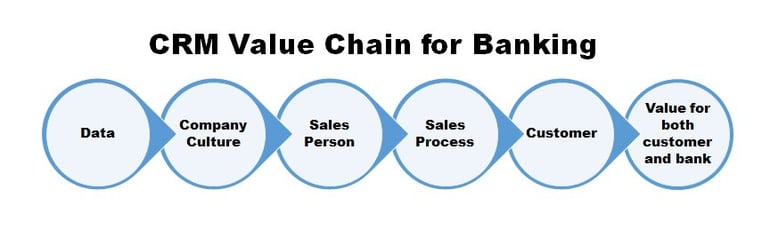

CRM in banking

The final word

CRM systems provide a level of engagement between customers and institutions. This engagement is the backbone of building a business that has high returns. In a highly competitive market, there is a need for efficient service delivery and high-end relations with customers and potential customers alike. Salesforce’s automated CRM offers a huge competitive advantage to financial services companies, and the best part is that each firm can develop different innovative ways of applying the system to improve their position in the financial market. With Salesforce, 45% of bank customers today regularly interact with their institution through a mobile channel.

Need help with deciding which CRM is right for your financial institution? Contact our consultants and we will work with you to devise the perfect integration strategy, approach, and plan that will work with your budget and current infrastructure.

Leave a Comment